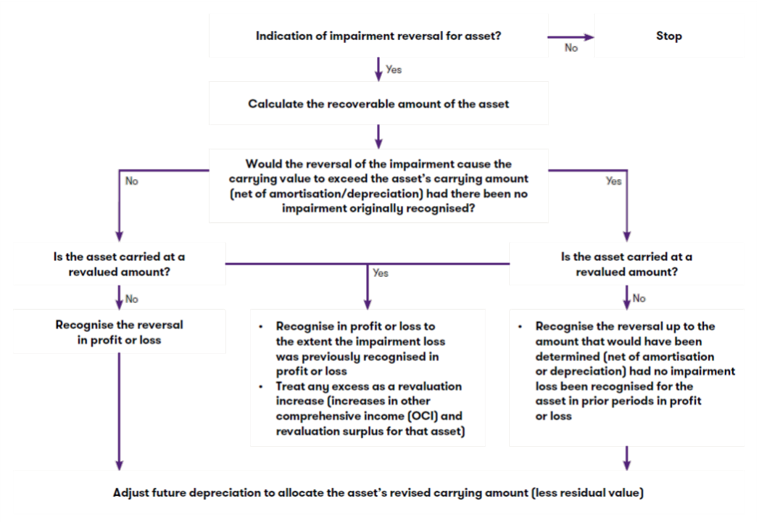

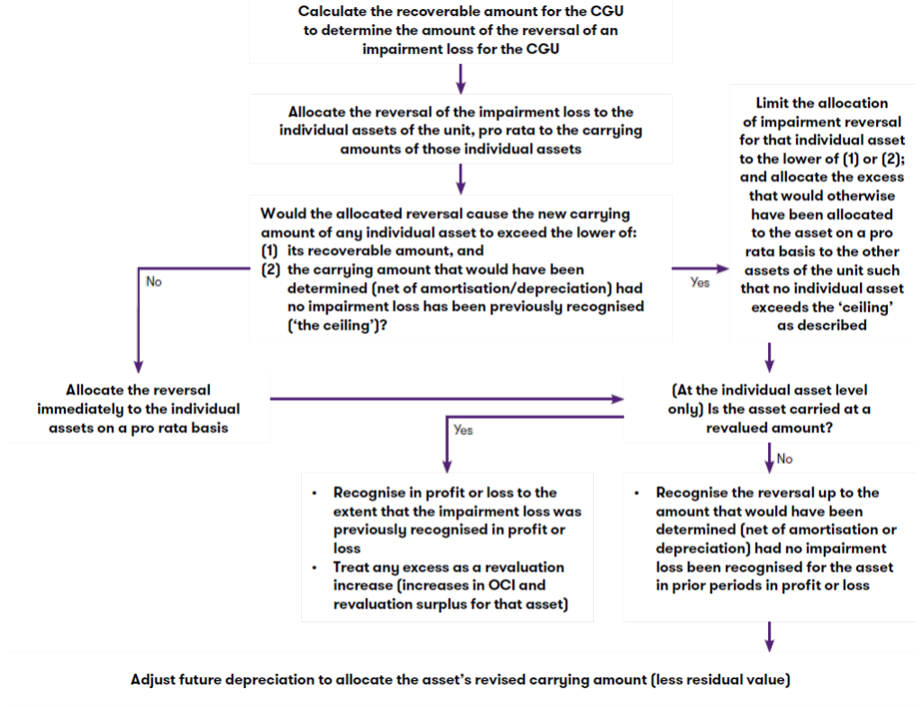

When assessing how much of the impairment loss it can reverse in Year 4 X needs to consider. Reversal of impairment loss.

11 1 Chapter 11 Depreciation Impairments And Depletion

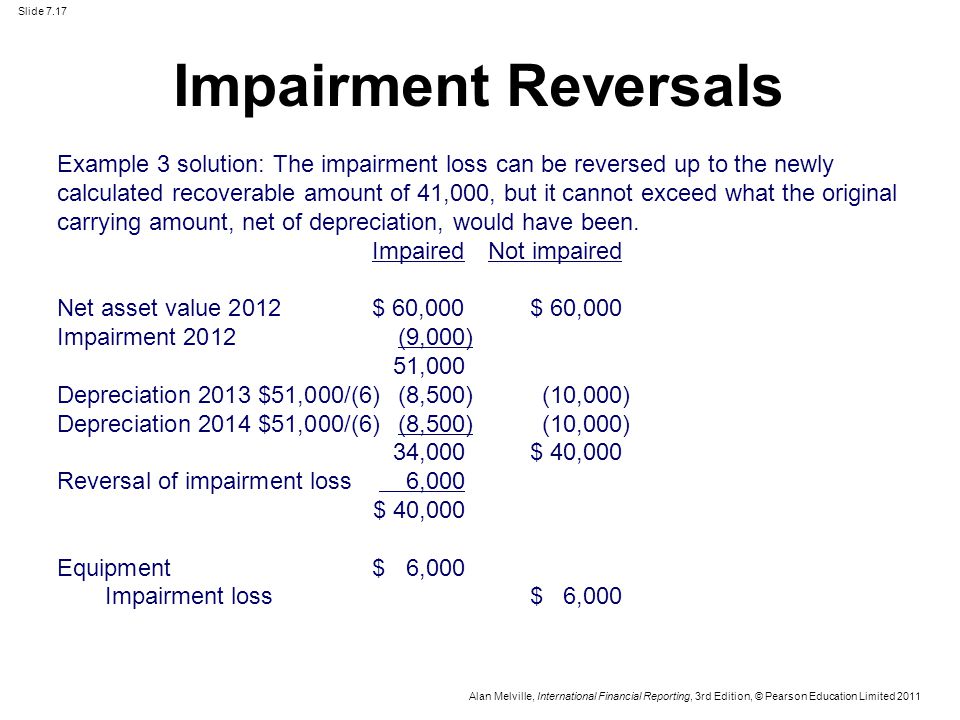

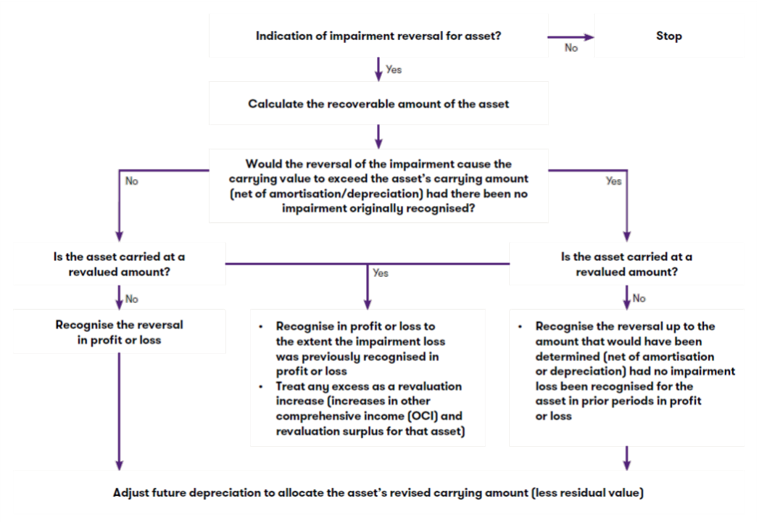

The impairment loss should be reversed but only to the extent that it does not exceed the carrying amount that would have been determined had no impairment loss been recognised in prior.

. 1333 lakhs per year to Rs. Recognise or reverse any impairment loss. 18 70 - 2 x 70 18 62.

IAS 36121 Reversal of an. Reversals of impairment losses for debt securities classified as available-for-sale or held-to-maturity securities are prohibited. This treatment is applicable on following types of fixed assets.

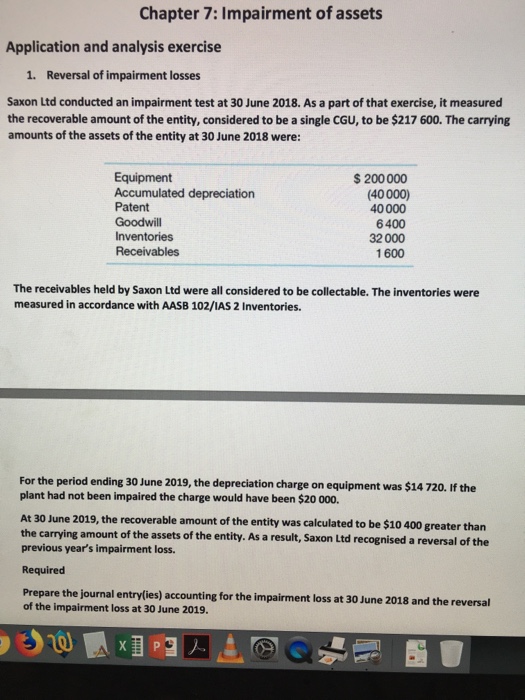

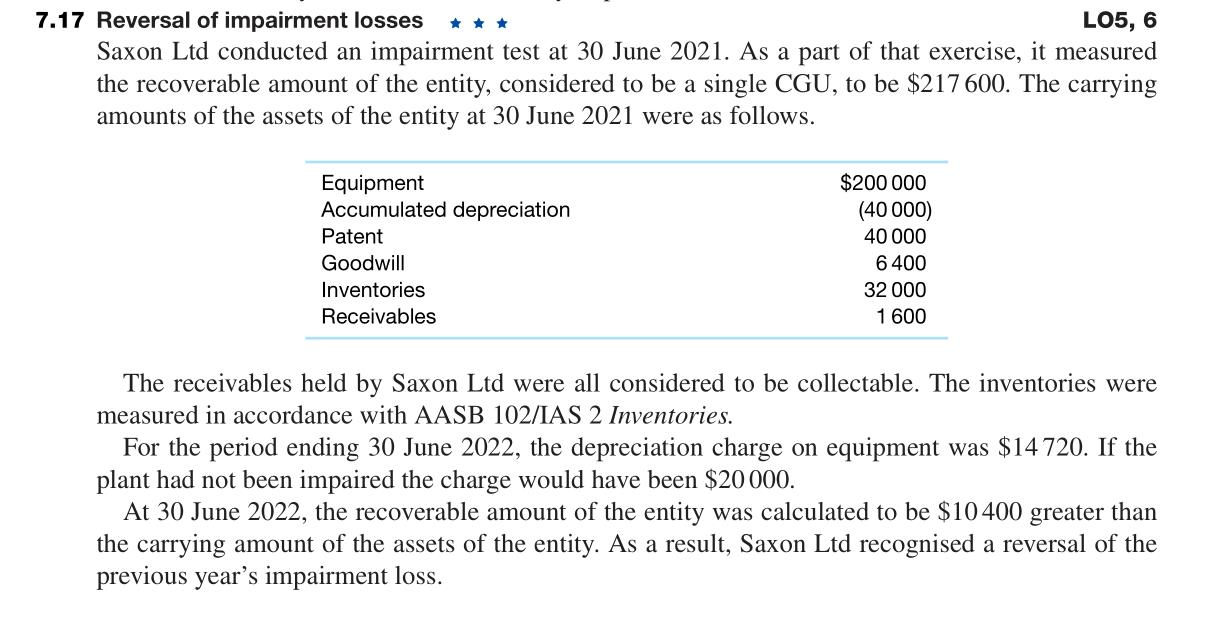

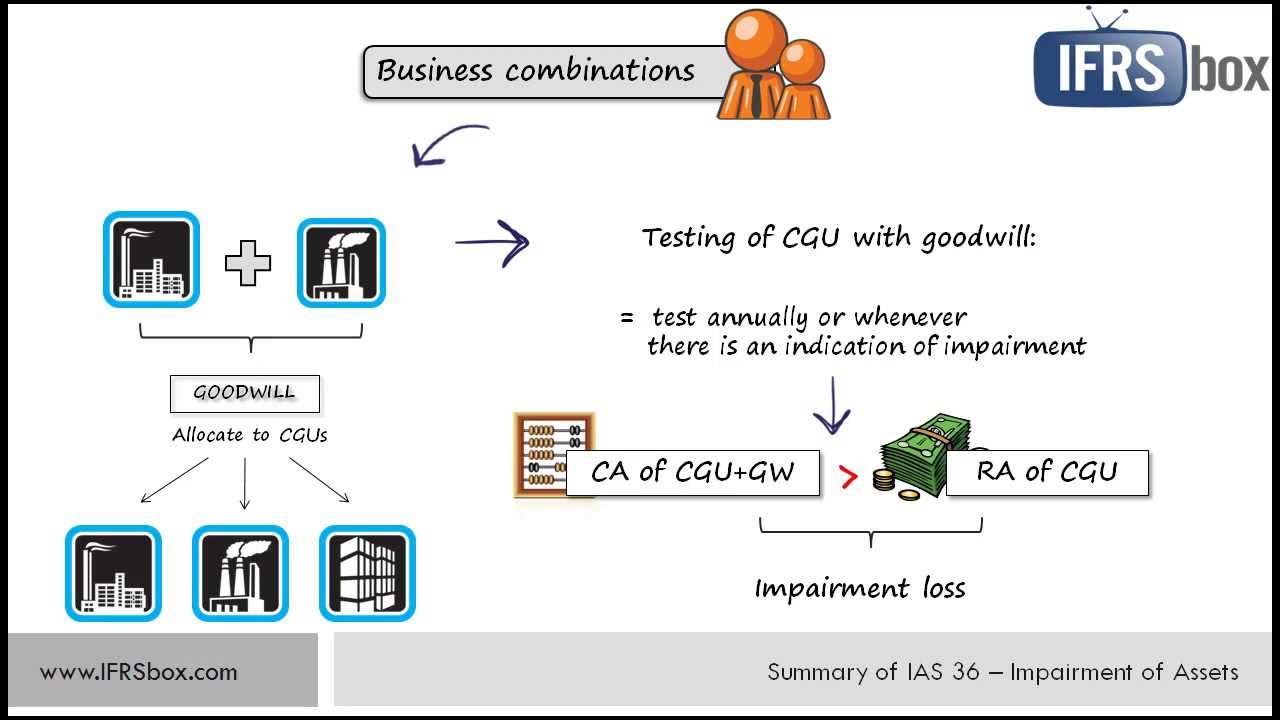

Impairment loss Carrying. The objective of IAS 36 Impairment of assets is to make sure that entitys assets are carried at no more than their recoverable amount. At each balance sheet date you should assess whether any impairment loss recognized in prior accounting periods no longer exists or has decreased.

Dr Profit or Loss Account 2000 Cr Asset Account 2000. Reversal of impairment losses. The requirements for recognising and measuring impairment losses differ based on the structure of the impairment.

Consistent with other US GAAP impairment guidance ASC 340-40 Other Assets and Deferred CostsContracts with Customers does not permit entities to reverse impairment losses. Reversal of impairment losses of a disposal groups assets occurs when an asset held for sale is impaired but then revalues as follows. 122 A reversal of an impairment loss for a cash-generating unit shall be allocated to the assets of the unit except for goodwill pro rata.

Now your post asks about the reversal of a previous impairment lets say the reversal is for 900. Reversal of an Impairment Loss. Impairment loss Reversal Recoverable Amount - Net Book Value.

Rather any expected recoveries in future cash flows are. In either case you should then. It is calculated by the following simple formula.

17092019 by 75385885. Reversal of impairment is a situation where a company can declare an asset to be valuable where it has previously been declared a liability. Paragraphs 94 to 100 set out the requirements for reversing an impairment loss recognised for an asset or a cash-generating.

Reversing an impairment loss for a cash-generating unit. 1After recognition of the impairment loss at the end of 20X4 T revised the depreciation charge for the Country A identifiable assets from Rs. Reversal of an impairment loss is recognised in the profit or loss unless it relates to a revalued asset IAS 36119 Adjust depreciation for future periods.

The technical definition of the impairment loss is a decrease in net carrying value the acquisition cost minus depreciation of an asset that is greater than the future undisclosed. The Standard also defines when an asset.

Chapter 9 Impairment Of Assets Ppt Download

Accounting For Impairments Of Ppe Youtube

Solved Chapter 7 Impairment Of Assets Application And Chegg Com

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Ias 36 Example Of The Reversal Of Impairment Youtube

Chapter 7 Impairment Of Assets Ias36 Ppt Video Online Download

Solved 7 17 Reversal Of Impairment Losses Lo5 6 Saxon Chegg Com

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

Solved Date Particulars Debit Credit 30 06 18 Acc Imp Loss Chegg Com

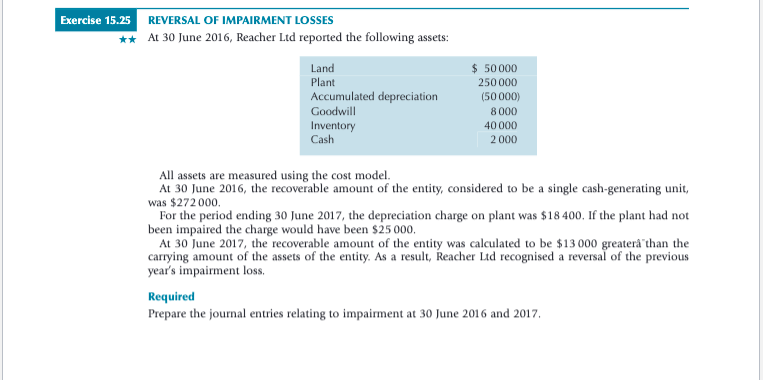

Solved Exercise 15 25 Reversal Of Impairment Losses At 30 Chegg Com

Question 4 Boxtor Ltd Purchased An Item Of Ppe On 1 4 2014 For 46 Course Hero

Ias 36 Impairment Of Assets Summary 2021 Youtube

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

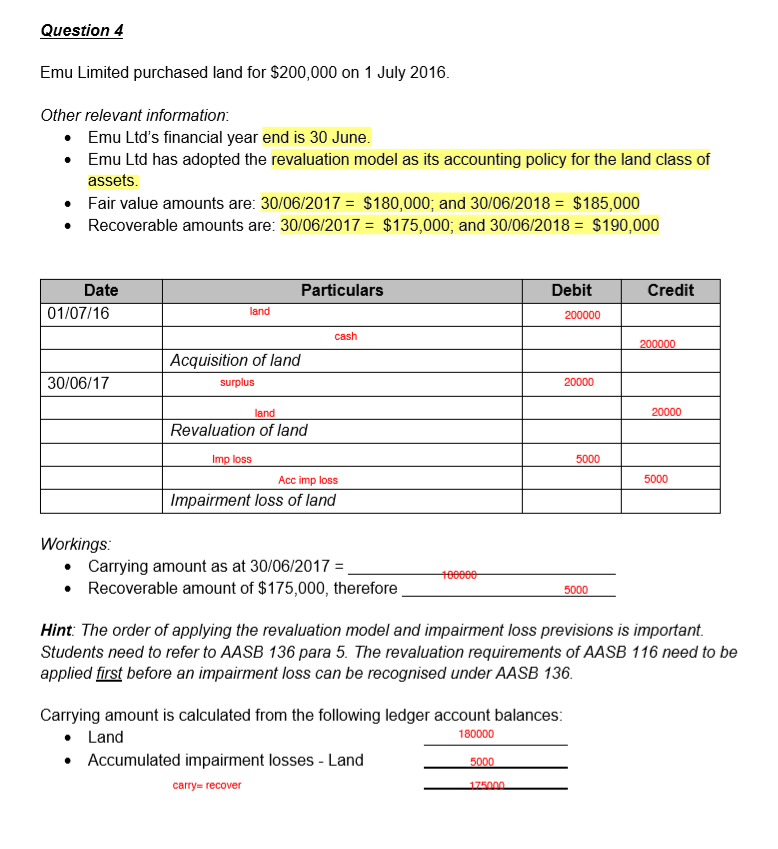

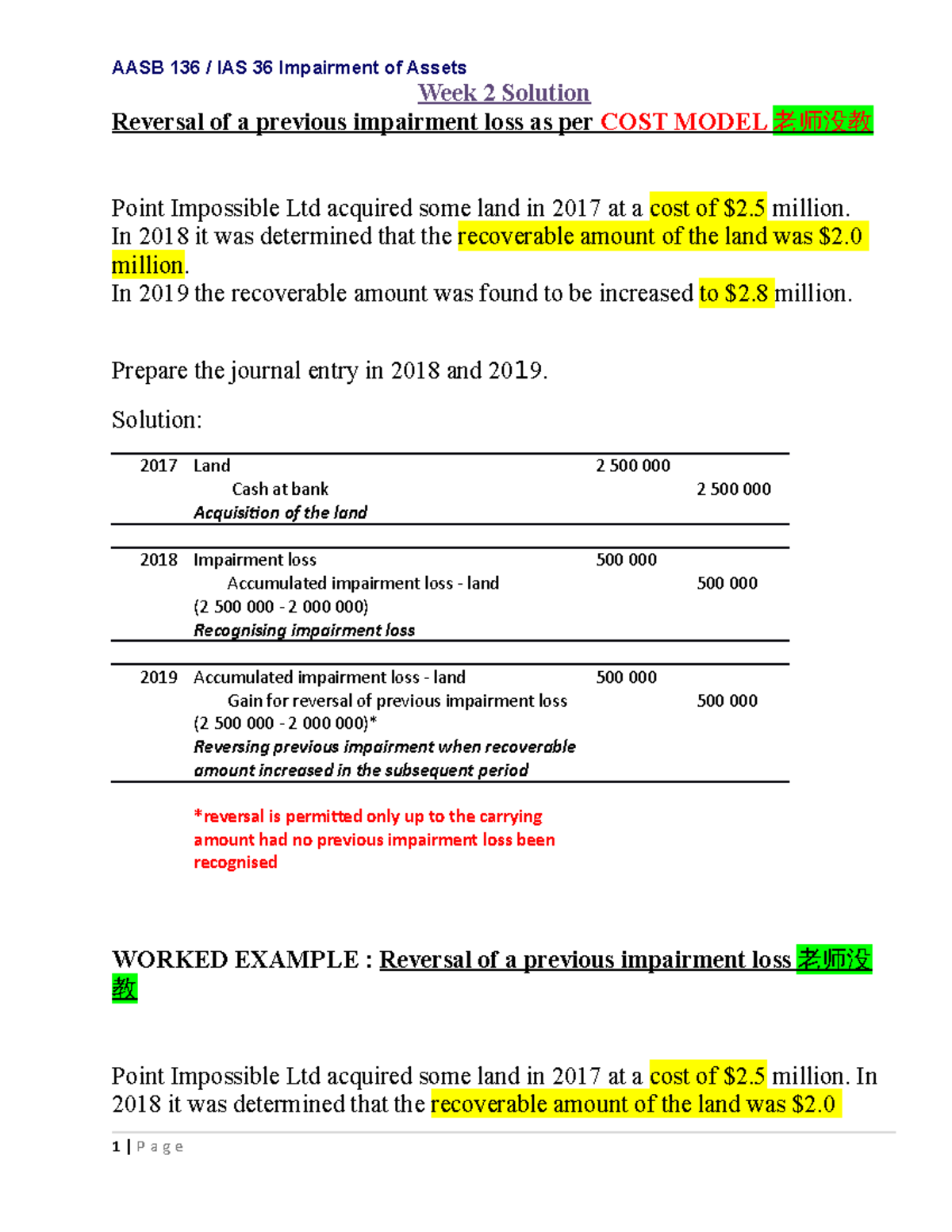

Aasb 136 Impairment Of Assets Aasb 136 Ias 36 Impairment Of Assets Week 2 Solution Reversal Of A Studocu

Ias 36 Updated Video Link In The Description Youtube

Reversal Of Impairment Losses Annual Reporting

Solved 7 18 Cgus Reversal Of Impairment Losses 05 6 The Chegg Com

Ifrs Ias 36 Reversing Impairment Losses Grant Thornton Insights

12 1 Chapter 12 Intangible Assets Intermediate Accounting